1. Analysis

Price action analysis is about observing how prices move on a chart without relying on indicators or complex formulas. Instead of looking at external factors, you focus solely on how prices behave. This means watching for patterns like trends, reversals, and support and resistance levels.

By understanding these patterns, traders can make decisions based on what the price is doing right now, rather than trying to predict future movements using complicated methods. So, essentially, “act according to the actions of price movement” means making trading decisions based on what the price is doing on the chart at that moment.

2. Timeframe

Day trading

5 minute, 15 minute, 1 hour

Swing trading

1 hour, 4 hour, 1 day

3. Strategy

Consolidation Breakout

- Identify Consolidation: First, you look for a period of consolidation on the price chart. Consolidation happens when the price moves within a relatively narrow range after a trend or a big price movement.

- Wait for Breakout: During consolidation, the price is essentially “coiling up” before potentially making a significant move. You wait for the price to break out of this consolidation range. A breakout occurs when the price moves above or below the boundaries of the consolidation range.

- Entry: Once you spot a breakout, you enter a trade in the direction of the breakout. For example, if the price breaks out above the consolidation range, you might enter a long (buy) position. If it breaks below, you might enter a short (sell) position.

- Confirm with Volume: Some traders also look for confirmation of the breakout with increased volume. Higher volume during the breakout suggests stronger momentum and increases the reliability of the breakout signal.

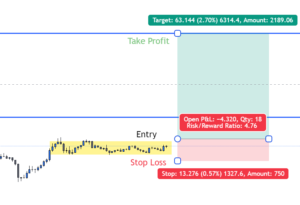

- Manage Risk: As with any trading strategy, it’s crucial to manage risk. You can place a stop-loss order below the breakout point to limit potential losses if the breakout fails.

- Target Profit: You might set a profit target based on factors like the size of the consolidation range or key support/resistance levels.

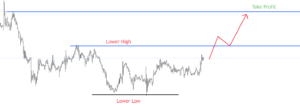

First, understand the scenario if we do analysis as a swing trader and take entry as a day trade at a lower timeframe it would lower your risk and higher your reward in each trade.

As you can see on the chart market is bullish on a higher timeframe 1 hour, 4 hour, 1 day so we now try to take long position at a lower timeframe 5 minute, 15 minute.

As you can see in the above picture we took long position at lower timeframe and stop loss at 5 minute timeframe whereas our Take profit was at higher timeframe. We stretch this position as a swing trade by trailing stop loss and booking half profit after some interval.

4. Pro Tips

Practicing the same strategy again and again for over 2 months until you have confidence in it.

I recommended practicing on fundednext free competition so you get interested because they give rewards to the first 100 positions and also a free funded challenge so overall it’s good learning and a chance to get funded free of cost.

Other than that you get knowledge of the MT5 platform, different pairs of trading, pips, lot size, etc. It’s a win-win game whether you get rewarded or not your practice on a single strategy will reward you in the future. and If you are an experienced trader and looking for a prop firm funded challenge my first recommendation would always be FTMO.